Written By: Sudeshna Ghosh

Key Takeaways

- Quantzig’s approach enabled a leading US-based CPG Multinational Manufacturer to not only improve their MMM model with an uplift of 12% but also enhance ROMI on the channels of focus immediate next marketing cycle after solution adoption by 7%.

- The client was facing challenges with an outdated MMM approach. Their traditional model, characterized by a once-a-year planning cycle, lacked the agility to provide dynamic insights for digital channels and integrate internal marketing performance data effectively.

- By implementing a hybrid MMM + MTA solution with weekly data refreshes, the client was able to enhance their planning process and make more informed decisions throughout the year, rather than being confined to a once-a-year planning cycle.

- Integrating internal marketing performance data and leveraging advanced analytics techniques such as attribution modeling and sensitivity analysis are crucial for optimizing marketing effectiveness.

Introduction

Enterprises are actively pursuing more efficient methodologies for evaluating performances across diverse networks. One such emerging metric, the TACOS (Total Advertising Cost of Sales), is garnering increasing attention compared to the conventional Return on Advertising Spend (ROAS), particularly for streamlining comparative analyses with greater efficacy. This case study sheds light on how Quantzig helped a CPG Multinational client to achieve New built MMM with an uplift of 12% over the original incumbent model and an improved ROMI on the channels of focus immediate next marketing cycle after solution adoption by 7%.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoQuantzig Success Story

| Client Details | A leading US-based Consumer Packaged Goods (CPG) Multinational Manufacturer |

| Challenges Faced by the Client | The client’s primary challenge included an outdated MMM approach. Their traditional model, characterized by a once-a-year planning cycle, lacked the agility to provide dynamic insights for digital channels and integrate internal marketing performance data effectively. |

| Solutions Offered by Quantzig | By implementing a hybrid MMM + MTA solution with weekly data refreshes, the client was able to enhance their planning process and make more informed decisions throughout the year, rather than being confined to a once-a-year planning cycle. |

| Impact Delivered | New built MMM had an uplift of 12% over the original incumbent model. Client was able to improve ROMI on the channels of focus immediate next marketing cycle after solution adoption by 7%. |

Client Overview

In a rapidly evolving digital landscape, a leading US-based Consumer Packaged Goods (CPG) Multinational faced significant challenges with their traditional Marketing Mix Modeling (MMM) approach. Hindered by centralized budgeting and outdated methodologies, the client struggled to adapt to the dynamic nature of digital channels and leverage internal marketing performance data for strategic decision-making. To address these hurdles and enhance marketing effectiveness, the client turned to Quantzig, a premier analytics and advisory firm, for innovative solutions.

Challenges Faced by the Client

The client, operating with a centralized budgeting structure and decentralized execution for both digital and non-digital channels, grappled with an outdated MMM approach. Their traditional model, characterized by a once-a-year planning cycle, lacked the agility to provide dynamic insights for digital channels and integrate internal marketing performance data effectively. This hindered their ability to optimize channel allocation and maximize return on marketing investment (ROMI).

Solutions Offered by Quantzig

Quantzig embarked on a comprehensive transformation journey to modernize the client’s MMM approach. Initially, a hybrid MMM + Marketing Attribution (MTA) solution was implemented, featuring weekly data refreshes to enable more adaptive planning throughout the year. An intelligence layer was constructed to facilitate attribution modeling for channels lacking direct revenue recognition, followed by the calculation of baseline revenue and granular channel-wise revenue breakdown. Sensitivity analysis was conducted to identify efficient spending boundaries for each channel, accompanied by ROI measurements. Additionally, a simulation toolkit was developed, empowering marketing analysts to explore various budgeting scenarios and channel allocations.

Quantzig’s Retail Marketplace Analytics-Driven Approach: Impact Delivered

The implementation of Quantzig’s innovative solutions yielded significant improvements in marketing effectiveness for the client. The new MMM approach witnessed a remarkable uplift of 12% over the incumbent model, indicative of its enhanced predictive capabilities and adaptability to changing market dynamics. Moreover, the client experienced a notable 7% improvement in ROMI on the focal channels during the immediate next marketing cycle post-adoption of the solution, underscoring the tangible business value delivered.

Through collaboration with Quantzig, the client successfully overcame the challenges associated with traditional MMM methodologies and achieved substantial improvements in marketing effectiveness. By embracing a modernized approach featuring weekly data refreshes, attribution modeling, and simulation capabilities, the client is now equipped to make informed, data-driven decisions to optimize channel allocation, drive ROMI, and stay ahead in an increasingly competitive landscape.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotBenefits from Quantzig’s Retail Media Network Analytics

Quantzig’s Unified Marketing Decision Management (MDM) initiates with comprehensive measurement and attribution of marketing expenditures, facilitating customers in determining the anticipated revenue in the absence of promotional activities. Furthermore, it aids in identifying the effectiveness of promotions across various scenarios, devising allocation and reallocation strategies for promotional budgets, and establishing efficient expenditure boundaries for each channel and promotion type.

Within our MDM framework, clients benefit from the ability to precisely quantify the impact of their marketing initiatives, consolidate outcomes across multiple brands, simulate media plans to assess virtual returns, and ultimately optimize them for enhanced performance.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your Free Trial TodayChallenges in Implementing Retail Media Network Analytics

Integrating data from various marketing channels, each characterized by distinct formats, velocity, volume, and variety, poses a complex challenge that necessitates advanced analytics and machine learning solutions. These sophisticated tools are essential for programmatically identifying, attributing, and recommending optimal investment strategies tailored to each channel’s unique attributes.

Read more: Building an Effective e-Commerce Business Strategy with the Help of Web Mining and Text Analytics

Importance in Embracing Retail Media Network Analytics

Return on Marketing Investment (ROMI) stands as a pivotal metric sought after by Chief Marketing Officers (CMOs) for optimization and maximization. In light of the evolving landscape featuring a myriad of new-age digital and physical channels, the marketing ecosystem has become increasingly diverse, offering numerous channel options and versatile strategies for brands to effectively engage with customers. Employing an integrated marketing framework enables strategic budget optimization while adeptly responding to market risks and seizing opportunities.

Understanding TACOS

The TACOS (Total Advertising Cost of Sales) metric introduces a novel approach to assessing advertising effectiveness, particularly within the realm of retail media networks. In contrast to Return on Advertising Spend (ROAS), which calculates the ratio of advertising revenue to advertising costs, TACOS evaluates advertising expenditure relative to total revenue (inclusive of both paid and organic sources), offering a comprehensive perspective on the financial performance of a business.

Leveraging TACOS stabilization as part of a comprehensive marketing strategy offers numerous advantages for businesses. By utilizing performance comparison metrics and a robust visualization platform, companies can identify areas for improvement and implement targeted optimization strategies. This approach allows businesses to focus on high-performing segments while ensuring long-term business growth. Through the integration of Retail media and the measurement of metrics such as Total ACOS (TACOS) and Share of Voice (SOV), organizations gain valuable insights into advertising effectiveness and market presence. Ultimately, the advantage of TACOS lies in its ability to provide a holistic view of advertising performance, guiding strategic decisions and driving success in competitive markets.

Read more: Retail Marketing Analytics Helps Retail Client Witness 10% Rise in Sales Margin

TACOS vs ROAS

| Metric | TACOS (Total Advertising Cost of Sales) | ROAS (Return on Advertising Spend) |

| Definition | Measures advertising spend against total revenue | Calculates revenue generated per advertising dollar spent |

| Calculation | Total Advertising Cost / Total Revenue | Revenue Generated from Advertising / Advertising Cost |

| Scope | Comprehensive view of advertising effectiveness, including indirect impacts and overall business performance | Narrow focus on immediate return on advertising investment |

| Advantages | Provides a holistic view, accounting for both direct and indirect advertising impacts | Offers a quick snapshot of campaign effectiveness for short-term decision-making |

| Focus | Evaluates advertising efficiency in relation to overall business revenue | Focuses solely on the return generated from advertising spend |

| Interpretation | Reflects the overall impact of advertising efforts on business outcomes | Indicates the immediate effectiveness of advertising campaigns |

| Application | Suited for businesses seeking a broader understanding of advertising ROI and long-term strategy alignment | Ideal for short-term campaign evaluation and immediate performance assessment |

Retail Media Network: An Overview

A retail media network encompasses an advertising infrastructure consisting of a range of digital channels, such as websites and applications, offered by retail entities to third-party brands for diverse advertising endeavors. Investing in ad space within a retail media network can significantly contribute to the enhancement of digital marketing strategies for brands across various scales.

With the surge in consumer preference for online shopping, retailers are increasingly recognizing the value of their digital channels as lucrative avenues for facilitating brand engagement with shoppers. This trend not only facilitates marketers in reaching more pertinent audiences but also furnishes brands with valuable insights into audience behavior and shopping patterns, thereby enhancing the efficacy of their retail marketing endeavors.

Understanding the dynamics of the Retail Media Network landscape is crucial for businesses aiming to establish a strong market presence and optimize advertising efficiency. By navigating various networks and comprehending the nuances of the retail media landscape, companies can enhance their brand recognition and strategic focus. Effective campaign management within the Retail Media Network enables businesses to showcase their diverse product ranges and capitalize on relevant product categories. Overall, a comprehensive overview of the Retail Media Network empowers businesses to leverage opportunities effectively, strengthen market presence, and drive sustained growth in today’s competitive retail environment.

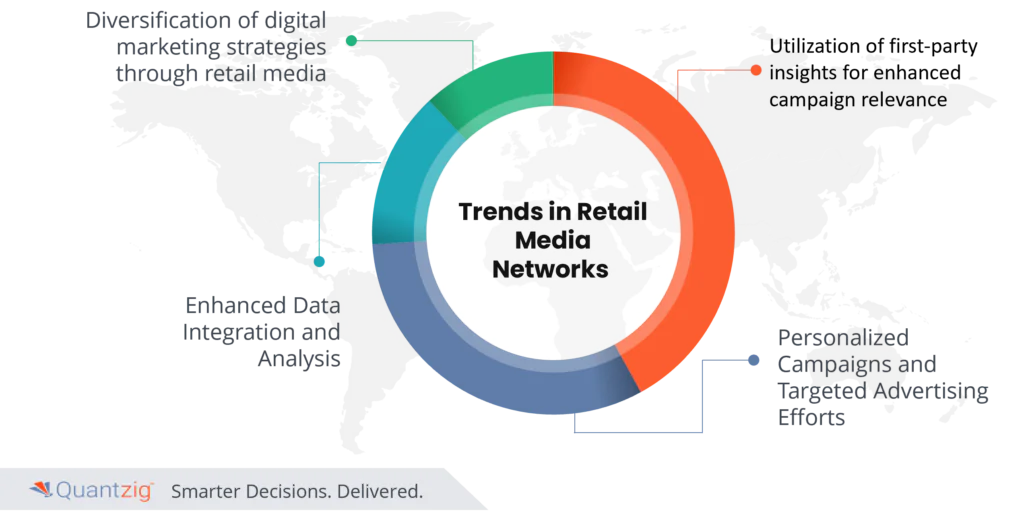

Trends in Retail Media Networks

Retail media is increasingly integrated into the advertising strategies of marketers aiming to optimize their ad expenditure and target relevant audiences effectively. Several emerging trends within the retail media industry are worth noting:

Diversification of digital marketing strategies through retail media: Marketers, in the face of a dynamically evolving advertising landscape, seek reliable insights to inform their campaigns and cultivate resilient marketing strategies. Retail media offers a platform for brands to diversify their digital marketing efforts in response to industry changes.

Utilization of first-party insights for enhanced campaign relevance: Leveraging first-party insights enables brands to craft tailored advertisements that resonate with shopping audiences, enhancing their perception of relevancy. This strategic approach not only fosters a sense of connection between shoppers and ads but also enables brands to optimize their ad expenditure more effectively.

Enhanced Data Integration and Analysis: In the evolving landscape of retail media networks, there’s a notable trend towards more structured approaches to data integration and analysis. Retailers and media buyers are prioritizing the seamless integration of advertising data and sales data through sophisticated data wrangling and data transformation techniques. This allows for more robust performance comparison and segmented analysis, enabling businesses to identify high-performing segments and optimize campaign management and budget allocation. With a comprehensive monitoring and visualization platform, companies gain deeper sales insights and drive immediate return while aligning with long-term business goals.

Personalized Campaigns and Targeted Advertising Efforts: Another prominent trend in retail media networks is the shift towards personalized ad campaigns and targeted advertising efforts. Retailers and media buyers are leveraging advanced data integration and segmented analysis to tailor campaign lengths, product ranges, and creative elements to specific product categories and customer segments. This trend emphasizes the importance of strategic focus and flexibility in campaign management, allowing for tailored timelines and versatility in response to changing market dynamics. By focusing on brand recognition and market presence, businesses drive conversions and ensure overall success in their retail media initiatives, fostering long-term business growth.

As the retail media landscape continues to evolve, it is poised to become an invaluable and insightful facet of digital advertising, offering brands enhanced opportunities for strategic targeting and campaign optimization.

Conclusion

In conclusion, TACOS (Total Advertising Cost of Sales) represent more than a mere metric; it serves as a framework through which to evaluate the efficacy of advertising efforts in driving overall strategic success in commerce. Through adept implementation and optimization of TACOS within retail media initiatives, businesses can ascertain that their advertising endeavors significantly contribute to sustained long-term business expansion.