Written By: Sudeshna Ghosh

Table of Contents

Introduction to Big Data Analytics in Banking

With nearly half of the world’s adult population embracing digital banking, financial institutions find themselves at a critical juncture. The vast amounts of data generated by these digital interactions present a unique opportunity for institutions to reevaluate their operational strategies, ultimately enhancing efficiency, customer-centricity, and profitability.

Many banks are continuously working on improving their existing data analytics, properly to give them a competitive edge or to predict emerging technologies and trends that can impact their businesses. This blog delineates the several ways that the banking sector can use big data analytics at every stage of its customer lifecycle.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoWhy do Banks Need Data Analytics?

1. Transformative power of analytics in banking

Under banking and financial services, the integration of data analytics has become a transformative force. It plays a pivotal role in shaping and fostering innovation and strategic decisions. Leveraging advanced data analytics techniques, banks gain invaluable insights into market trends, customer behavior, and operational efficiency.

2. Future prospects with big data

In the upcoming future, the banking industry with big data holds the promise of unprecedented growth and advancements. As banks embrace analytics, they are propelled toward a data-driven paradigm that enables real-time decision-making and a more personalized approach to customer interactions. From customer relationship management to risk management, analytics integration in banking and financial services ensures an agile and proactive response to ever-changing market dynamics.

3. Synergy between analytics and financial services

The synergy between analytics and financial services becomes a catalyst for competitive differentiation and growth. As banks navigate the complexities of the modern financial ecosystem, the strategic incorporation of analytics empowers them to stay ahead of the curve, enhancing customer satisfaction, and offering tailored services and innovative solutions. The future of banking with big data lies in the symbiotic relationship between analytics and financial acumen, driving this industry toward a new era of customer-centricity, efficiency, and strategic foresight.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your Free Trial TodayThe Four Vs of Big Data in Financial Institutions

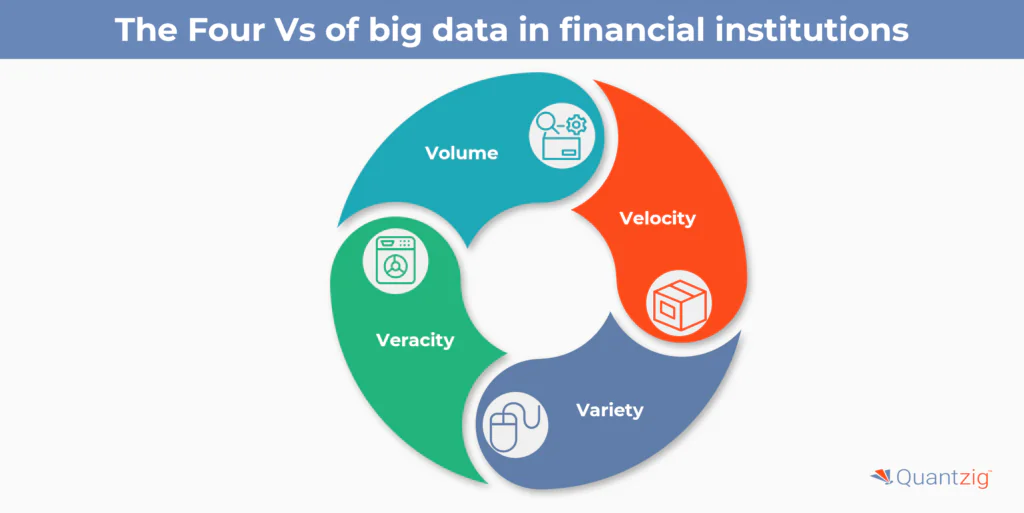

The Four Vs—Volume, Velocity, Variety, and Veracity—direct the strategic application of big data analytics in the world of financial institutions. Optimizing the value obtained from data assets and improving operational effectiveness requires an understanding of and utilization of these dimensions.

Variety:

Financial institutions handle diverse data formats, including structured (transaction records), semi-structured (XML files), and unstructured (social media feeds, emails). Robust data integration tools are essential for managing this variety effectively.

Veracity:

Data precision and consistency (veracity) are critical for sound financial decisions. Adhering to strict data governance, conducting frequent quality evaluations, and employing advanced cleansing methods ensure high data veracity, enhancing analytical capabilities, customer trust, and regulatory compliance efficiency.

Velocity:

Financial data flows at a rapid pace, requiring timely processing and analysis to derive actionable insights. Utilizing efficient data management tools and real-time analytics enables financial institutions to keep pace with this velocity, facilitating swift decision-making and responsiveness to market changes.

Volume:

Financial institutions deal with large volumes of data from various sources. Implementing scalable data storage solutions and powerful analytics tools allows them to handle this volume effectively, extracting valuable insights and optimizing business operations.

Financial institutions can drive innovation and accomplish strategic goals by transforming raw data into actionable insights by adopting the Four Vs of Big Data. Financial institutions can fully utilize big data to obtain a competitive advantage in the ever-changing financial landscape by tackling issues related to volume, velocity, variety, and veracity.

What are the Benefits of Big Data in Banking?

Advantages of big data analytics in the banking industry are multifaceted. Real-time analytics enable improved risk management, fraud detection, and compliance monitoring. Additionally, the uses of big data in banking encompass credit scoring, customer segmentation, and sentiment analysis, contributing to a more agile and responsive banking ecosystem.

The advantage of data in banking extends beyond mere information – it empowers institutions to gain valuable insights into customer behavior, market trends, and operational efficiency. Furthermore, the advantage of big data amplifies these benefits by allowing for the analysis of vast datasets. The advantages of big data in banking range from improved decision-making and enhanced customer experiences to operational optimization.

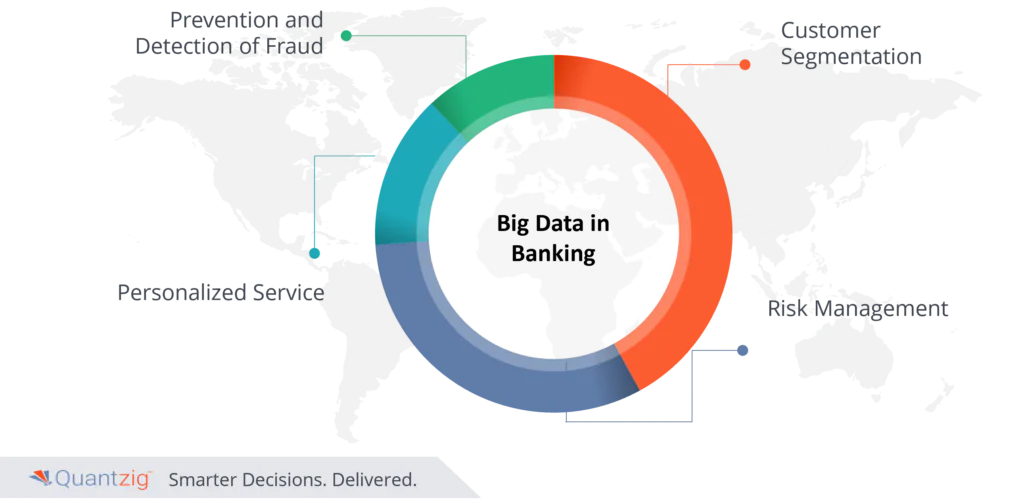

1. Prevention and Detection of Fraud

Big data in banking can help deal with one of the biggest challenges faced by banks today – frauds. Banks and financial organizations use analytics to find the difference between fraudulent interactions and legitimate business transactions. With the help of analytics and machine learning, banks can easily define normal activity on the basis of customer history and differentiate it from unusual behavior, indicating fraud. The use of Big Data Analytics Banking systems will help suggest immediate actions like blocking any irregular transactions. This stops fraud before it occurs and enhances profitability.

2. Customer Segmentation

The use of big data in banking provides comprehensive insights into customers’ spending patterns and helps in understanding their needs and requirements. Through the use of big data in banking, banks can also categorize their customers based on different parameters like preferred credit card expenditures, commonly accessed services, and even net worth. This form of customer segmentation can enable the banks to target their customers in a better way through relevant marketing campaigns.

3. Personalized Service

Customer segmentation facilitated by big data in banking services can be used to create and deliver schemes and services designed for specific customers as per their requirements. The past and present expense analysis can clearly tell the banks how to get a higher response from their customers. Personalized products and services help the banks to create more meaningful relationships with their customers.

4. Risk Management

Detecting fraud at the early stage forms a large part of risk management. The use of big data analytics financial services in banking can help manage risk efficiently for the banks. It locates and presents huge data on a single platform, minimizing the number of risks to a manageable number. Big data plays a pivotal role in integrating the requirements of the banking industry into the centralized platform. This helps the banks to reduce the frauds and manage risk.

Companies in the banking industry, by keeping up with big data and other upcoming trends, can understand the client’s requirements in a better way. This can, therefore, help in improving banking services. The task of implementing big data in banking is taking shape and soon it will be adopted completely by the entire industry.

The implementation of AI-driven chatbots improves customer service, while heightened risk assessment accuracy strengthens risk management practices. Both retail banking and corporate banking sectors benefit from big data by better understanding market dynamics and customer needs, thus enhancing investment banking strategies. Moreover, big data helps in identifying and mitigating security threats, ensuring a secure banking environment. Overall, big data enables banks to manage the entire customer lifecycle more effectively, from acquisition to retention, driving long-term business success.

The Transformative Impact of Big Data in Banking

The banking sector, a cornerstone of global economies, generates an enormous amount of data every second. Once considered static and functional, primarily for financial institutions and auditing purposes, this data has gained new life through big data technologies. The advent of big data in banking has revolutionized the industry, offering numerous benefits that we will explore in the following subsections.

1. Personalized Customer Experience

Big data technologies enable banks to understand their customers on a granular level. By analyzing various customer data points, such as investment habits, shopping behaviors, and financial backgrounds, banks can offer personalized banking solutions. This not only enhances customer satisfaction but also helps in predicting and preventing customer churn.

2. Customer Segmentation

Machine Learning (ML) and AI, combined with big data analysis, allow for effective customer segmentation. Banks can categorize their customers based on multiple parameters, such as credit card expenditures or net worth, enabling targeted marketing campaigns that resonate more closely with individual customer needs.

3. Effective Analysis of Customer Feedback

Big data tools can sift through customer profiles and feedback to identify questions, comments, and concerns. This enables banks to respond promptly to streamlined customer feedback, fostering a sense of value and trust among customers, which in turn enhances customer loyalty.

4. Fraud Detection and Prevention

Big data analytics can monitor customer spending patterns and identify unusual behavior, thereby preventing unauthorized transactions and enhancing the overall security of the banking industry. Additionally, it can identify fraudulent behaviors like identity fraud.

5. Business Process Optimization and Automation

Big data technologies can automate up to 30% of all work within banks, leading to significant cost savings and reduced risk of human error. Companies like JP Morgan Chase employ AI and ML programs to optimize processes like algorithmic trading and commercial-loan agreement interpretation.

6. Improved Cybersecurity and Risk Management

AI and big data technologies are instrumental in identifying fraud and preventing internal risks. Banks are investing in data science companies that specialize in real-time ML and predictive modeling to enhance cybersecurity measures.

7. Enhanced Employee Performance and Management

Big data solutions offer real-time performance metrics, providing better visibility into day-to-day operations and enabling proactive problem-solving. Companies use data analytics software to monitor metrics like customer acquisition, retention, and employee efficiency.

8. Informed Lending Decisions

Big data analytics offer a more comprehensive view of a bank’s customer database’s financial health, enabling more nuanced lending decisions. Companies like Kreditech use unconventional models that combine big data with sources like social media to assess the creditworthiness of potential borrowers.

9. Advanced Client Support

AI-powered virtual assistants like Bank of America’s Erica are examples of big data implementation in banking. These virtual assistants can resolve client queries, remind them about important dates, and even help improve spending habits.

10. Advanced Analysis of Stock Prices

Big data technologies enable in-depth analysis of potential investment targets, considering factors like social reputation, environmental impact, and human capital. Deutsche Bank uses its a-DIG tool to analyze these intangibles to make informed investment decisions.

These ten benefits underscore the transformative power of big data in banking, offering unprecedented opportunities for customer engagement, operational efficiency, and risk management. As the banking sector continues to evolve, the strategic implementation of big data will be crucial for institutions to maintain a competitive edge and deliver exceptional services to their customers.

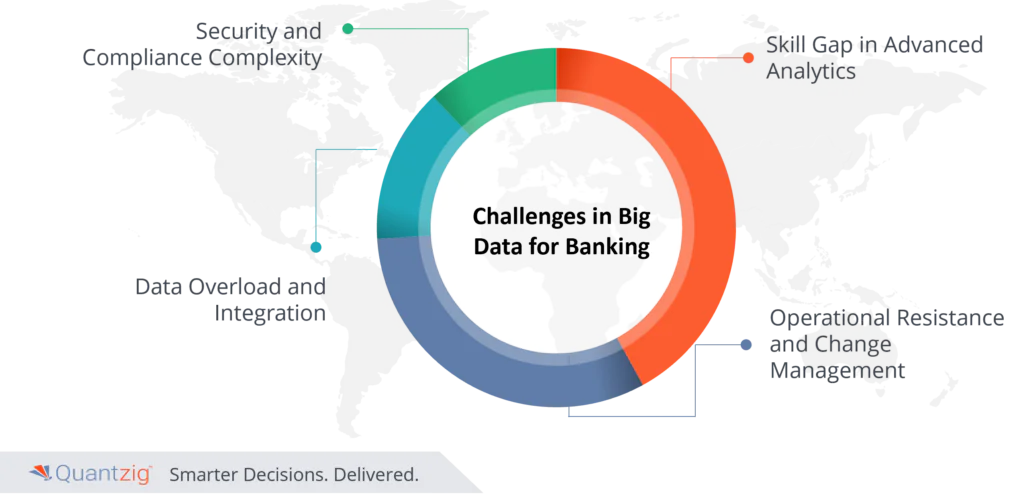

Challenges in Big Data for Banking Industry:

1. Security and Compliance Complexity:

The primary challenge in incorporating big data into the banking sector is ensuring the security and regulatory compliance of the extensive datasets involved. Leveraging big data necessitates robust measures to protect sensitive information, aligning with the complex network of regulatory requirements. The benefits of data utilization must be carefully weighed against the critical need to maintain data integrity, confidentiality, and adherence to the evolving compliance standards.

2. Skill Gap in Advanced Analytics:

As the financial services industry becomes increasingly dependent on data analytics, a critical challenge arises in the form of a significant skills gap. The benefits of this technology can only be fully realized when professionals are adept in advanced analytics techniques. Many banks are struggling with the need to upskill their workforce to navigate the use cases of analytics in banking, retail banking analytics, and the complexities of analytics in investment banking, while ensuring a comprehensive understanding of the analytics used in the banking and finance sectors.

3. Data Overload and Integration:

With the increasing number of data sources in analytics for banking and financial services, organizations face the challenge of handling an overwhelming amount of data and integrating diverse datasets. The banking industry’s big data analytics necessitates a smooth integration of structured and unstructured data from various channels. The benefits of big data can be impeded by the complexity of harmonizing data from different sources within the banking sector.

4. Operational Resistance and Change Management:

The institutionalization of big data analytics faces resistance within banking operations. Change management becomes a critical challenge, particularly in organizations where traditional methods still hold sway. The advantages of using big data necessitate a cultural shift towards embracing analytics in banking and finance, fostering an environment that values data-driven insights and leverages analytics in banking and finance to drive strategic decision-making.

Addressing these challenges of big data in banking industry requires a holistic approach, combining technological investments, talent development, and strategic alignment to unlock the full potential of big data in the banking industry.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotThe Future of Big Data in Banking: Opportunities and Challenges

In banking, big data promises innovation and enhancement through advanced technology. AI-driven decision-making will automate processes like risk assessment, boosting efficiency. Personalized customer experiences, enabled by big data analytics, will enhance satisfaction and loyalty. Blockchain technology will fortify data security, ensuring transaction integrity. Real-time analytics will bolster fraud detection and decision-making. Open banking, facilitated by big data, will enhance customer offerings. Sustainability and social responsibility will be promoted through data-driven insights. Regulatory technology (RegTech) will streamline compliance processes, reducing risks. Financial inclusion will be advanced through tailored products. Global expansion will be facilitated by data-driven market insights. Human-centric design, informed by data, will enhance intuitive banking experiences, ensuring resilience and innovation in a dynamic digital era.