Author: Associate Vice President, Analytics and Data Strategy, Quantzig.

Table of Contents

Key Observations

- The financial services industry is undergoing significant change, with banks and investment planning companies needing skilled professionals.

- True transformation requires aligning people, skills, and technology with market demands and regulatory compliance.

- Generative artificial intelligence (Gen AI) presents both opportunities and risks, offering benefits through big data and data-driven insights.

- Ensuring robust cybersecurity is essential for navigating this evolving landscape.

Introduction to the Challenges of banking sector

The Financial Services Industry is a dynamic and complex sector that plays a crucial role in the global economy. As the industry continues to evolve, it faces a myriad of challenges that demand innovative solutions to ensure its survival and growth. In this era of digital transformation, these institutions grapple with issues ranging from outdated procedures and cybersecurity risks to meeting the diverse expectations of customers across different demographics. Addressing these challenges requires a strategic approach that leverages cutting-edge technologies, such as artificial intelligence (AI), to stay competitive in an ever-changing landscape.

Request a demo to experience the meaningful insights we derive from data through our telecom analytics tools and platform capabilities.

Request a Free DemoFinancial industry analysis: An Industry Overview

The financial services industry encompasses several businesses that are engaged in managing money. This sector plays a vital intermediary role in the world’s economy. Over the past several years, this industry has evolved through a series of digital transformation. These developments have prompted the industry to become more customer centric. Financial services companies are no longer just competing with other financial firms for consumers’ attention and loyalty. Rather, companies in this industry are now forced to compete with anyone who’s offering a positive experience, including consumer and technology brands. As modern companies in the global financial services industry are more inclined to use technology in order to engage their customers on a deeper level, they are expected to create better relationships and provide more value.

current issues in banking: Financial Services Challenges

The financial services landscape has undergone a myriad of changes owing to the advent of fintech startups and the changing business models, mounting regulation, disruptive technologies, and compliance pressure. Moreover, changing customer demands are adding to these mounting challenges. In this article, Quantzig identifies some of the biggest challenges facing this industry and puts them in perspective.

- Rising Competition: The financial services industry faces increased competition from FinTech entrants, pushing banks and investment planning companies to form partnerships or make acquisitions. Learning from these new players’ customer experience strategies is crucial for survival.

- Regulatory Compliance: Soaring regulatory fees and risks compel financial services institutions to invest in technology that manages big data, provides data-driven insights, and ensures regulatory compliance, balancing costs and risks effectively.

- Evolving Business Models: Challenges for accounting and finance professionals such as increasing costs and low-interest rates drive banks and investment planning companies to adapt their business models, enhancing customer retention and operational efficiency while staying agile in a competitive market.

- Data Security: With rising cybercrime risks, financial services institutions must focus on cybersecurity, leveraging cloud computing, generative artificial intelligence (Gen AI), and advanced technology to safeguard customer data and maintain robust defenses.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized telecom analytics solutions services built across the analytical maturity levels.

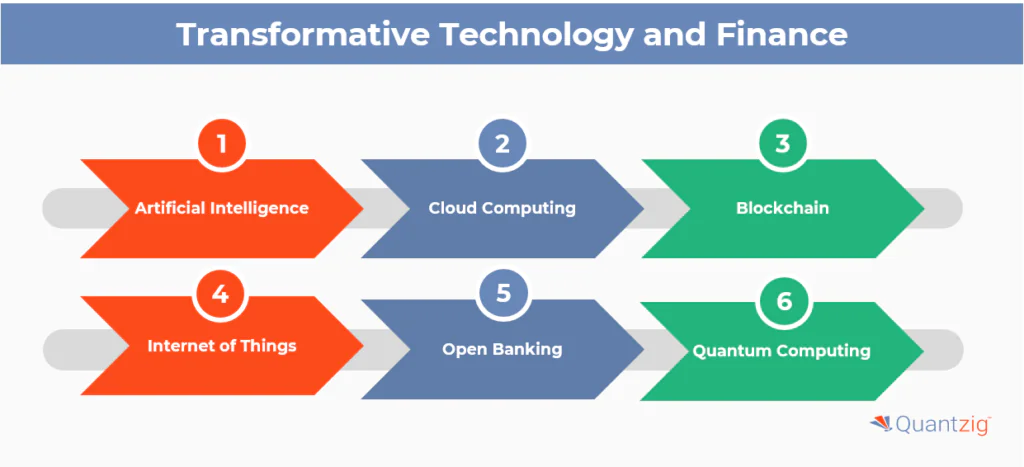

Request a free pilotHow will transformative technology drive change with the problems in the banking industry?

Transformative technology is revolutionizing the financial services industry, creating fresh opportunities for both consumers and businesses. Let’s delve into how emerging technologies are driving this transformation:

Artificial Intelligence:

AI has the potential to add up to $1 trillion in value annually to the global banking industry. Financial institutions are increasingly adopting an AI-first approach to stay competitive against expanding technology firms. AI applications span various financial operations:

Customer-facing applications include personalized products, intelligent service robots, chat interfaces, automated transactions, robo-advisors, and alternative credit ratings based on non-financial data.

Middle-and-back office applications involve smart processes, knowledge representation tools (like knowledge graphs), and natural language processing for fraud detection.

Privacy-aware data analysis tools, such as federated learning and advanced encryption, enhance consumer protection.

Cloud Computing:

The cloud enables organizations to operate without managing physical IT assets. It provides agility and scalability, crucial for rapid product development and deployment. Financial firms can integrate and recompose enterprise data assets, products, services, and applications in the cloud, fostering faster innovation.

Blockchain:

Distributed ledger technology (DLT) ensures secure and transparent transactions. It has the potential to revolutionize financial protocols and enhance trust in finance.

Internet of Things (IoT)

IoT devices collect real-time data, enabling personalized services, risk assessment, and fraud detection. IoT bridges the gap between the physical and digital financial worlds, creating novel ways to generate and access data.

Open Banking:

Open APIs allow third-party developers to build applications and services around financial institutions’ data. Open banking encourages innovation, competition, and customer-centric solutions.

Quantum Computing:

Quantum computers can solve complex problems faster than classical computers, optimizing portfolio management, risk assessment, and fraud detection for banks and investment planning companies in the financial services industry. AI-powered robo-advisors, utilizing generative artificial intelligence (Gen AI), provide automated investment advice based on individual preferences and risk tolerance. These technologies democratize access to financial advice and investment strategies, enhancing customer experience and promoting customer retention.

Additionally, the integration of big data, data-driven insights, and cloud computing within financial services institutions not only improves operational efficiency but also strengthens cybersecurity measures against cybercrime. Ensuring regulatory compliance remains crucial for accounting and finance professionals in this evolving FinTech landscape.

In summary, transformative technology is reshaping financial services, enhancing efficiency, security, and customer experiences. Financial institutions must embrace these innovations to thrive in the evolving landscape.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a free proposal

How QZ Solutions Can Help Solving the Financial Challenges?

Quantzig, a leader in innovative data analytics and business intelligence solutions, plays a pivotal role in addressing the financial services challenges. Through a combination of AI-driven technologies, risk management services, and compliance solutions, our solution helps financial institutions navigate the complexities of the modern landscape.

The company provides Automation and AI training data services, enabling these organizations to enhance their AI systems and automate operations, particularly in customer support and digital customer experiences. Our expertise in data labeling services ensures ridiculously good data quality, facilitating accurate decision-making processes.

In addition to this, Quantzig offers unique solutions in blockchain technology, helping these institutions secure sensitive information and mitigate cybersecurity risks. Their innovative approaches to technology-driven security measures and identity verification workflows align with the industry’s need for robust risk management and compliance solutions.

As financial institutions strive to cater to the demands of diverse demographics and deliver omnichannel services, our experts emerge as a valuable partner in ensuring a simplified and personalized customer experience. Through cloud-based technology stacks and cutting-edge CRMs, we support financial institutions in meeting customer expectations across various channels, including mobile banking and social media.

Surviving in the financial services industry requires a strategic blend of innovation, risk management, and customer-centric approaches. Quantzig stands as a support, providing the necessary tools and augmented technologies solutions to navigate the challenges and thrive in a competitive landscape.

Conclusion

In conclusion, Quantzig’s multifaceted approach and commitment to innovative data analytics and business intelligence solutions empower financial institutions to navigate the complex and ever-evolving landscape of the modern financial services industry. Through the integration of AI-driven technologies, robust risk management and compliance solutions, and cutting-edge approaches to customer experience, Quantzig enables these institutions to meet the demands of a diverse market while securing their operations against risks and emerging threats. By partnering with Quantzig, financial organizations can leverage expert insights and tailored solutions to achieve strategic growth, enhance customer experiences, and maintain a competitive edge in the industry.