Table of Contents

Marketing Optimization in Banking: An Introduction

In the rapidly evolving landscape of banking, the strategic allocation of resources, particularly in marketing spend, plays a pivotal role in optimizing client outcomes. Banking institutions are navigating a dynamic terrain encompassing branch banking, online banking, and a multitude of digital channels. Achieving customer satisfaction, loyalty, and seamless connectivity across these channels requires a comprehensive approach. Leveraging information databases, analytics, and understanding customer behavior patterns are imperative for effective decision-making.

The integration of multichannel capabilities within the technological landscape is a key focus, ensuring a holistic view of customer segments. As financial services undergo digital transformation, the transition from traditional to digital banking becomes paramount. This necessitates a phase-wise approach to customer transition, acquisition, considering customer lifetime value and the unique needs of both technologically literate and non-digital customers. Optimizing marketing spend is not merely about profit/loss considerations but also about streamlining operations, gaining valuable customer insights, and enhancing the customer experience.

This article delves into the transformative journey of leading financial institutions, exploring how they leverage advertising spend optimization to enhance sales volume, engagement frequency, and overall customer relationships in a modern, data-informed environment. Through a focus on cost-effectiveness and leveraging digital channels, these institutions successfully position themselves to cater to the diverse preferences of their customer base, be it through mobile banking, online knowledge centers, or brick-and-mortar locations.

Highlights of the Case Study:

| Particulars | Description |

| Client | A leading bank that sought to improve transparency in marketing spending and outcomes |

| Business Challenge | Our client wanted to assess the suitability or appropriateness of their current business practices vis-a-vis the returns. |

| Impact | Quantzig’s decision-making framework helped our client reduce the risk of misallocating or underfunding high-priority campaigns and initiatives. |

Game-Changing Solutions for Banking Industry

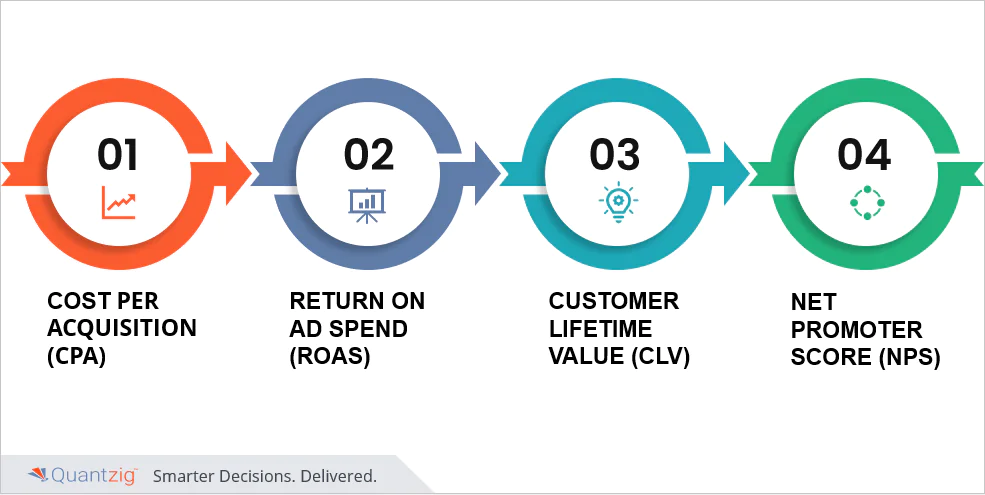

Investment banks and other BFSI industry players make marketing spend analysis decisions in banking that involve branding campaigns and promotions, allocation of budgets for ad platforms, and identifying the channels and frequency of media touchpoints. They need to evaluate the impact of these on a weekly, monthly, or quarterly basis to assess customer acquisition costs (CAC). In an age of limited personnel resources, time, and budgets, marketers in the BFSI industry must continuously seek to improve business outcomes with limited spending. Many of these marketers tend to overlook and undervalue common signals for accurate decision making, such as the following:

- Cost per acquisition (CPA)

- Return on Ad Spend (ROAS)

- Customer lifetime value (CLV)

- Net promoter score (NPS)

The spend analysis for banking team at Quantzig provides an optimal solution to banks and marketers in the BFSI industry with our Decision Management framework. We help them determine how these common signals drive rewards, goals, costs, and risks.

The modern Marketing Optimization in Banking – competing channels and digital demands

Digital transformation technology strategy, digitization and digitalization of business processes and data, optimize and automate operations, customer service management, internet and cloud computing.

1. Multichannel Integration and Technological Landscape:

In the contemporary banking arena, the multifaceted challenge of channel optimization unfolds against the backdrop of a rapidly evolving technological landscape. Financial institutions find themselves navigating through diverse channels, including branch banking, online banking, and mobile banking, to meet the dynamic expectations of technologically literate customers. The integration of digital channels becomes paramount, requiring a delicate balance between physical branches and web or mobile-based interactions. Achieving a seamless multichannel integration not only enhances customer satisfaction but also demands a strategic approach to streamline operations, ensuring cost-effectiveness in the face of operational costs and maximizing valuable insights through advanced analytics.

2. Holistic View of Customers and Customer Insights:

A pivotal aspect of channel optimization lies in gaining a holistic view of customers. Through comprehensive data-informed decision making, financial institutions can delve into customer behavior patterns and preferences, essential for personalized business strategies. The importance of Customer Insights for Banking is accentuated in the transition phase, wherein a phase-wise approach to customer acquisition considers the distinct needs of both digital and non-digital customers. Leading institutions, armed with a wealth of information from information databases, not only optimize their marketing spend efficiently but also foster customer loyalty by aligning products and services with segments, whether digital or non-digital.

3. Digital Transformation and Customer Experience:

The digital transformation sweeping through financial services necessitates a reimagining of the customer experience. From digital products and services to full-service automated financial assistants, institutions strive to create a modern environment that resonates with the expectations of digital-only customers. Social media emerges as a powerful tool to engage customers, enhance sales volume, and increase engagement frequency. Investment in online knowledge centers further reinforces the customer experience, providing valuable resources and information. The push towards a digital customer base is not just a trend but a strategic imperative, requiring a profound understanding of customer relationships in this new, digitally driven landscape.

4. Strategic Marketing Spend for Optimal Results:

In the pursuit of channel optimization, financial institutions leverage a phased approach to customer acquisition, optimizing advertising and promotional spend for maximum impact. The calculation extends beyond mere profit/loss considerations, encapsulating the holistic perspective of customer lifetime value. Home Equity Line of Credit (HELOC) and additional products strategically cater to the diverse needs of the clientele. The judicious allocation of resources is particularly crucial for leading financial institutions competing in the market, where sales volume, engagement frequency, and a seamless user experience are paramount. As the industry embraces data-driven decision making, a strategic marketing spend becomes the linchpin for success in this fiercely competitive, modern banking environment.

The Challenges of the Banking Client

Our client employs various methods to drive business growth, such as television ads, digital and print media, and seasonal promotions. It also offers higher returns on fixed deposits during the festive seasons to incentivize customers to choose its services. These activities led our client to spend around $300,000 annually on its campaigns without proactively budgeting. Quantzig worked with the bank to observe its existing decision-making process and identify factors that can improve the transparency of its market spending and outcomes.

Our client wanted to assess the appropriateness of its current business practices. Secondly, it sought to determine whether it was targeting its marketing expenditure and content toward the right audiences at the right time through the most relevant channels to achieve the requisite outcome. Lastly, it wanted our marketing analytics team to recommend and develop a new decision-making framework to evaluate the effectiveness and results of its campaigns.

Quantzig’s Solution for Marketing Optimization in Banking

Banks generate vast amounts of data that can be leveraged to derive valuable insights. Quantzig’s marketing analytics team used Python as a coding language and machine learning concepts as statistical learning to analyze the business data of our clients in the banking sector.

In this case, our team used an accurate decision-making framework based on data-mining techniques. Our framework measured the accuracy and precision of our client’s existing business strategies. As a part of this project, our team used a trend model and accurately predicted the monthly marketing expenditure of our client. Secondly, we used a data-driven customer behavior segmentation technique through our recency frequency monetary (RFM) model. Our model used Pareto values and CHAID decision trees to rank and cluster our client’s customers based on their recent transactions. These practices helped us identify if our client was targeting its campaigns toward the correct customer group.

Quantzig also examined how our client’s business activities impacted its performance over the years. We obtained data from primary sources via questionnaires and interviews with the client’s customers. Hypotheses were tested using techniques such as Spearman’s rank correlation coefficient and Kendall’s coefficient of concordance to determine a relationship between our client’s budget and its profitability.

The objective of our decision-making framework was to help our client’s business team understand whether they were targeting their campaigns toward the right customers. This analysis showed that the client could redirect its marketing spending to high-value clients and minimize the customer category that was least receptive to their services.

Unlock the future of banking with Quantzig’s Channel Optimization solutions. Elevate your marketing spend efficiency through advanced analytics, multichannel integration, and a holistic approach to customer insights. If you also want to transform your banking strategy and enhance customer relationships,

Request a free proposalImpact Analysis of Quantzig’s Solution for Marketing Optimization

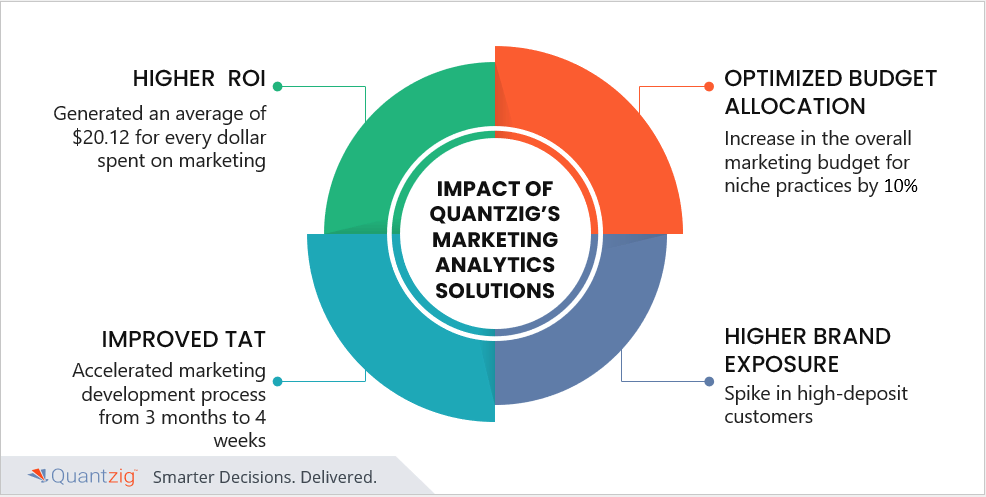

Our decision-making framework helped our client reduce its risk of misallocating or underfunding high-priority campaigns and initiatives. Our team focused on universal benchmarks such as CLV, CPA, and NPS to determine whether the marketing spending would have a positive ROI compared to other capital allocation opportunities.

The impacts of using Quantzig’s Decision Management framework were as follows:

- Reduced paid search advertising spend

- Expedited marketing budget development process from 3 months to 4 weeks

- An increase in the overall budget for niche practices by 10%

- Enabled our client to generate an average of $20.12 for every dollar spent on marketing

- Witnessed a spike in high-deposit customers

- Achieved higher brand exposure

Key Outcomes

Quantzig’s deployment of the Marketing Decision Management framework enabled our client to optimize its marketing spending by targeting the right customers to achieve a higher ROI. Our interventions led our client to generate an average of $20.12 for every dollar spent on marketing. It also maximized its brand exposure while reducing its paid search advertising spend. Our scientific, data-backed analysis helped our client expedite the budget development process from three months to four weeks. This quick turn-around time will have a significant role in achieving the client’s quarterly goals.

Broad Perspective on Marketing Spend Optimization in the BFSI Sector

The global pandemic has set precedence for tighter marketing spend management across various sectors, and the banking sector is no exception. The budgets of banks are closely scrutinized, and hence marketers need to redirect their spending toward higher revenue-generating channels. Quantzig’s data-driven approach helps marketers replace their existing business practices with our unique decision-making framework to develop a rational budgeting process.

Key Takeaways

The use of Quantzig’s Marketing Decision Management framework is beneficial in various ways:

- Reduces paid search advertising spend

- Helps to make business campaigns more effective

- Ensures higher conversion rates

- Achieves higher brand exposure

- Guarantees business growth and higher ROI

In conclusion, channel optimization stands as a cornerstone in the strategic framework of banking, particularly in the landscape of marketing spend efficiency. The intricate interplay between branch banking, online banking, and various digital channels demands a nuanced approach. By meticulously analyzing customer behavior patterns, leveraging information databases, and employing advanced analytics, financial institutions can make data-informed decisions that transcend profit/loss considerations. Implementing a phase-wise acquisition strategy, accounting for customer lifetime value, and ensuring multichannel integration within the technological landscape enables a seamless transition for both digital and non-digital customers.

The cost-effectiveness derived from streamlined operations and valuable insights positions institutions to cater to the diverse needs of their clientele. Embracing digital transformation through mobile banking, online knowledge centers, and digital channels fosters a modern environment. Leading financial institutions, cognizant of sales volume and engagement frequency, excel in channel optimization, creating a seamless experience. Whether through brick-and-mortar locations or web-based interactions, the holistic view of customers, coupled with innovative products such as Home Equity Line of Credit (HELOC) and full-service automated financial assistants, solidifies the enduring customer relationships in this dynamic landscape.