Table of Contents

Table of Contents

- Introduction to Pricing Analytics

- What is Pricing Analytics?

- Why is Pricing Analytics Important?

- What are the Tools to Conduct Pricing Analytics?

- How Pricing Analytics Improve Profitability?

- Pricing Analytics Types with Examples

- How will Artificial Intelligence Further Transform Pricing Analytics?

- Quantzig’s Expertise in Pricing Analytics Solutions

- Conclusion

Author: Associate Vice President, Analytics and Data Strategy, Quantzig.

Introduction to Pricing Analytics

Pricing analytics has become a critical tool for oil and gas companies to optimize their pricing strategies and improve profitability. By leveraging data-driven insights, these organizations can make more informed decisions about discounts and promotions, ultimately enhancing their competitiveness in the market. One key benefit of pricing analytics is the ability to identify pricing opportunities and optimize discount strategies. Through real-time monitoring of customer responses, competitor prices, and market conditions, companies can quickly adjust their pricing to capitalize on demand and maintain healthy profit margins. This is particularly important in an industry characterized by complex pricing structures, large product catalogs, and fluctuating market dynamics.

Request a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoWhat is Pricing Analytics?

Pricing analytics is the methodical examination of data to inform and guide decisions related to setting, adjusting, and optimizing prices. It involves analyzing customer data, market trends, competitor information, and cost structures to identify optimal price points that maximize revenue and profitability while meeting customer needs.

Why is Pricing Analytics Important?

The importance of pricing analytics for b2b businesses can be summarized as follows:

- Optimized Pricing Strategies: Pricing analytics techniques enable b2b companies to identify the most effective price points that balance customer satisfaction and maximize profitability. It helps align pricing with diverse customer needs and preferences.

- Enhanced Customer Segmentation: By understanding customer willingness to pay and price sensitivity, software companies can implement value-based pricing and tailor offerings to specific customer segments, improving customer acquisition and retention.

- Improved Profitability Management: Pricing analytics provides insights into price elasticity, enabling software companies to strategically manage customer acquisition costs, optimize revenue, and drive sustainable growth.

- Competitive Advantage: Comprehensive analysis of market trends, competitor pricing, and customer preferences allows software companies to create compelling value propositions, enhance perceived product value, and maintain a competitive edge.

- Operational Efficiency: Pricing analytics aids software companies in planning effective strategies by considering consumer spending patterns, forecasting demand, and managing operating expenses, contributing to overall operational efficiency.

- Customer Retention and Loyalty: By evaluating customer churn and cultivating brand promoters, pricing analytics helps software companies focus on profitable channels and maximize customer lifetime value, fostering long-term customer relationships.

- Adaptability to Dynamic Market Conditions: In the rapidly evolving software industry, pricing analytics equips businesses with the necessary tools to stay agile, make informed pricing decisions, and respond effectively to changing market dynamics.

Overall, pricing analytics is a crucial tool for software companies, addressing complexities in customer behavior, supply chain management, and market conditions, and enabling them to achieve sustained profitability and customer loyalty.

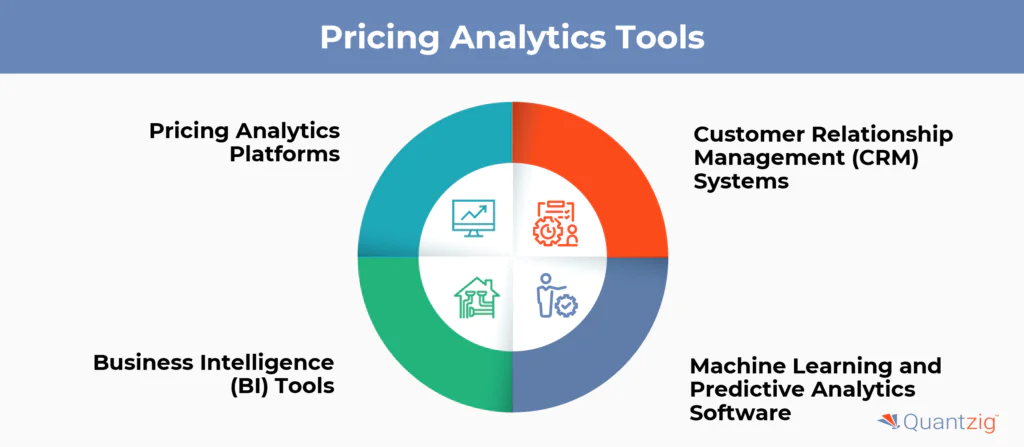

What are the Tools to Conduct Pricing Analytics?

1. Pricing Analytics Platforms:

Specialized strategic pricing analytics platforms, such as Zilliant or Pricefx, provide comprehensive solutions for software businesses to analyze pricing data, implement pricing strategies, and optimize revenue. These platforms often incorporate features like customer segmentation, value-based pricing, and predictive analytics. They enable businesses to leverage structured data for informed decision-making, ensuring effective subscription management and maximizing customer lifetime value.

2. Customer Relationship Management (CRM) Systems:

CRM systems like Salesforce or HubSpot play a crucial role in price analytics by capturing and organizing customer data. This includes information on referenceable customers, customer acquisition costs, and lifetime value. These systems contribute to effective customer segmentation, helping businesses tailor pricing strategies to individual customer needs and paying capabilities, ultimately enhancing customer loyalty.

3. Business Intelligence (BI) Tools:

BI tools like Tableau or Power BI facilitate the visualization and analysis of pricing metrics and market research data. Through dashboards and reports, businesses can gain insights into consumer behavior, purchase behavior, and market demand. These tools empower companies to identify pricing opportunities, plan pricing strategies, and optimize revenue management based on real-time information.

4. Machine Learning and Predictive Analytics Software:

Machine learning tools, including Python-based libraries like scikit-learn or dedicated predictive analytics software like RapidMiner, enable businesses to implement advanced pricing analytics models. These tools can analyze large datasets to predict pricing elasticity, forecast demand, and dynamically adjust pricing strategies. For example, they can help in understanding customer churn patterns and identifying psychological price points for different customer segments.

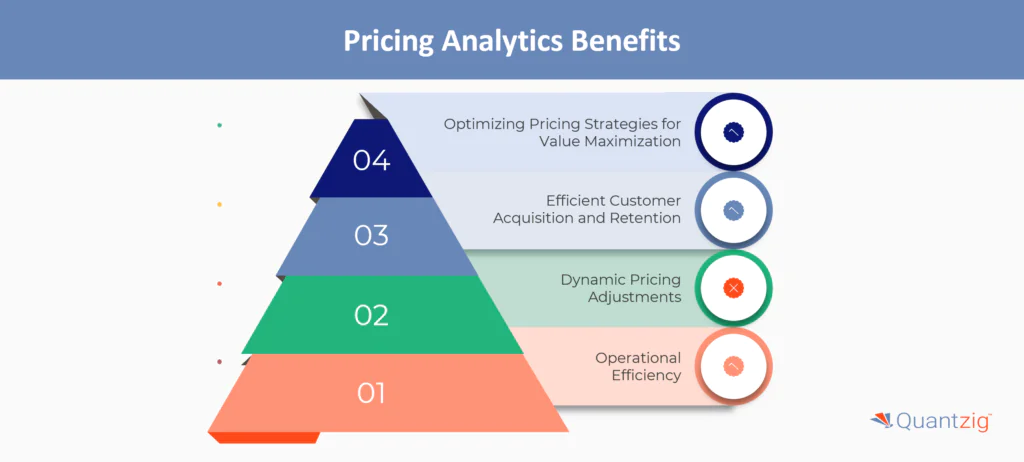

How Pricing Analytics Techniques Improve Profitability?

1. Optimizing Pricing Strategies for Value Maximization:

This tool enables software businesses to optimize their pricing strategies by incorporating factors like value-based pricing, price elasticity, and relative preference analysis. By understanding customer segmentation and their perceived value of the product, businesses can align their pricing decisions with the value proposition offered. This strategic alignment not only attracts more customers but also justifies premium pricing for products with augmented value, contributing to increased average revenue per user and overall profitability.

2. Efficient Customer Acquisition and Retention:

Through the analysis of customer acquisition costs, lifetime value, and customer churn, this solution aids in crafting effective customer acquisition and retention strategies. Businesses can identify the most cost-effective channels for acquiring customers and implement dynamic pricing to retain loyal customers. By minimizing customer churn and maximizing customer lifetime value, companies ensure a stable revenue stream, positively impacting overall profitability in the long run.

3. Dynamic Pricing Adjustments for Market Responsiveness:

This tool empowers businesses to make real-time adjustments to pricing based on market demand, supply chain dynamics, and operational efficiency. Utilizing demand-based pricing and forecasting tools, companies can adapt their pricing decisions to match consumer spending trends and seize pricing opportunities. This agility in pricing strategies ensures that businesses remain competitive and responsive to market changes, ultimately enhancing overall profitability.

4. Operational Efficiency and Cost Management:

This tool contributes to operational efficiency by providing insights into operating expenses and profitability by channel. By identifying profitable channels and optimizing pricing decisions accordingly, businesses can streamline their operations and allocate resources effectively. This not only reduces unnecessary costs but also ensures that pricing strategies align with operational efficiency, directly impacting the bottom line and improving overall profitability.

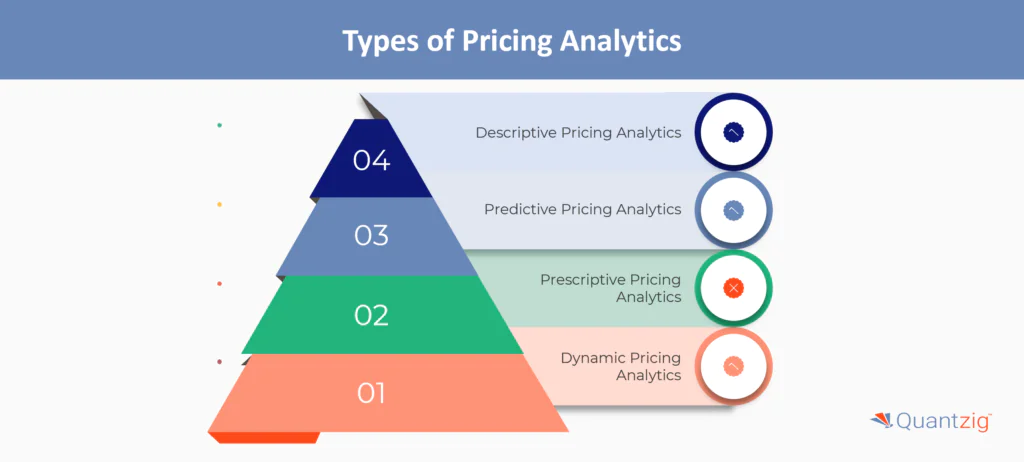

Strategic Pricing Analytics Types with Examples

1. Descriptive Pricing Analytics:

It involves the analysis of historical pricing data and patterns to gain insights into past performance. In the software business, this type of analytics helps in understanding the effectiveness of previous pricing strategies and identifying trends. For example, by examining average revenue per user over different time periods, businesses can assess the impact of pricing decisions on overall revenue.

2. Predictive Pricing Analytics:

It utilizes statistical models and algorithms to forecast future market trends and customer behavior. In the context of software pricing strategy, businesses can use predictive analytics to anticipate changes in market demand, enabling proactive adjustments to pricing decisions. Forecasting demand and consumer spending trends can guide companies in preparing for market shifts and optimizing pricing strategies accordingly.

3. Prescriptive Pricing Analytics:

It provides actionable recommendations based on data analysis. In the software sector, businesses can use prescriptive analytics to optimize pricing decisions by considering factors such as customer segmentation, price elasticity, and relative preference analysis. For instance, prescriptive analytics may suggest personalized pricing promotions to different customer segments based on their historical purchase behavior.

4. Dynamic Pricing Analytics:

This tool involves real-time adjustments to pricing based on various factors such as market demand, supply chain dynamics, and operational efficiency. In the software business, dynamic pricing can be implemented by considering factors like customer churn, subscription management, and changes in market demand. For example, a software company may dynamically adjust subscription prices based on customer loyalty and changes in market demand, ensuring competitiveness and revenue maximization.

Game-Changing Solutions for the Oil and Gas Retailing Business

Despite a decline in fuel use, customers continue to consider the cost of fuel when choosing which retailer to visit. Therefore, fuel retailers must remain vigilant about their competitors’ prices and promotional policies. Considering the price while bidding for customer attention is more critical than ever.

Quantzig can assist retailers in analyzing rival pricing and discount strategies to determine the best prices. Effective discounting methods directly impact profits, business expansion, and customer loyalty. The technologies also allow price adjustments in response to anticipated client demands without affecting organizational profitability.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific data statistics requirements. Pilot studies are non-committal in nature.

Request a Free PilotHow will Artificial Intelligence Further Transform Pricing Analytics?

Artificial intelligence (AI) is poised to further transform pricing analytics in the following ways:

- Enhanced Data-Driven Insights: AI-powered algorithms can analyze vast amounts of data from multiple sources, including customer behavior, market trends, and competitor pricing, to uncover deeper insights that inform more accurate and personalized pricing strategies.

- Automated Pricing Adjustments: AI can enable dynamic pricing by automatically adjusting prices in real-time based on factors such as supply, demand, and market conditions, allowing businesses to respond quickly to changing market dynamics.

- Personalized Pricing: AI can leverage customer data and preferences to offer personalized pricing, tailoring prices to individual customers or segments and maximizing revenue while maintaining customer satisfaction.

- Improved Forecasting and Optimization: AI-driven predictive analytics can enhance demand forecasting and price optimization, enabling businesses to identify the most profitable pricing points and strategies.

- Reduced Pricing Errors: AI can minimize human bias and errors in pricing decisions by automating the analysis and decision-making process, leading to more consistent and effective pricing strategies.

- Competitive Pricing Strategies: AI can analyze competitor pricing data and market intelligence to help businesses stay ahead of the competition and develop pricing strategies that maximize their market position.

- Scalable Pricing Capabilities: AI can automate and streamline pricing processes, allowing businesses to manage pricing at scale and across multiple products, channels, and regions more efficiently.

- Pricing Performance Monitoring: AI-powered analytics can continuously monitor pricing performance, identify areas for improvement, and provide real-time insights to help businesses optimize their pricing strategies over time.

- Generative AI for Pricing: Emerging generative AI technologies, such as Variational Autoencoders (VAEs) and Generative Adversarial Networks (GANs), can enhance data augmentation and improve the accuracy and reliability of pricing models.

By leveraging these AI-powered capabilities, businesses can gain a significant competitive advantage in the market, optimize their pricing strategies, and drive sustainable revenue growth.

Quantzig’s Expertise in Pricing Analytics Solutions for a Leading Saudi Arabian retailer in the oil and gas industry

| Particulars | Description |

| Client | A leading Saudi Arabian retailer in the oil and gas industry approached Quantzig for price optimization, competitive benchmarking, and real-time monitoring of price gaps to stay ahead of the competition. |

| Business Challenge | The client wanted to leverage Quantzig’s custom pricing analytics tools that could assess discounting methods and implement optimum pricing structure across channels. |

| Impact | Quantzig’s solutions helped our client increase sales and profit margins providing a helpful decision-making tool for real-time pricing and discounting. |

Oil Pricing Analytics Challenges of the Retail Client

A leading Saudi Arabian oil and gas retailer approached Quantzig because it was facing intense competition from competitors offering products at significantly reduced prices. Our client needed pricing optimization, competitive benchmarking, and real-time monitoring of price gaps for each of its product groups and consumer segments. The client wanted to leverage Quantzig’s custom pricing analytics tools to assess discounting methods and implement correct pricing structures across channels. Some of the critical issues that were negatively impacting the client were as follows:

- Variations in consumption behavior

- Fluctuations in the prices of oil and gasoline

- Rising costs of retail dealers and distribution

- Refining revenues and expenses

- Lower costs and incentives offered by competitors

Quantzig’s Oil Pricing Analytics Solutions

With AI, Quantzig could extract patterns and trends in consumer behavior and provide the client with a solution for calculating oil prices. Quantzig also used a data-driven strategy to estimate demand, flow, and price to maximize profit. Besides that, AI helped with risk management to help control volatility and uncertainty inherent in the oil and gas industry.

To create highly effective regional pricing and discount strategies, Quantzig also implemented a data-driven methodology for price optimization that uses predictive analytics and AI-based approaches. Our experts also looked at the client’s existing price structure and coupled it with marketing and sales data to construct an algorithm that anticipated customer behavior. Implementing a real-time discount dashboard created by Quantzig enabled managers or sales agents to respond to increases in sales volume. The client conducted a univariate analysis to understand the individual impact of discounts, price, and other variables on sales. It also devised a simulator to dynamically design discounting and pricing strategies for individual products and customer segments.

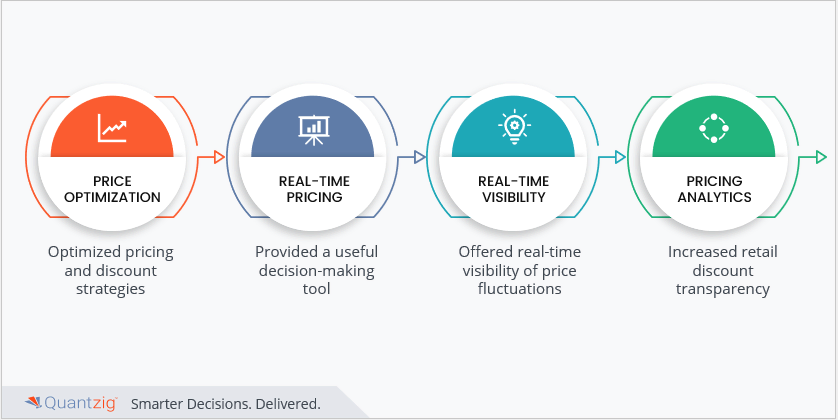

Impact Analysis of Quantzig’s Pricing Analytics Solutions

The ability of Quantzig’s pricing analytics solution to increase sales and profit margins has been steadily recognized by our clients as it helps to identify the best discount strategies while considering all production-line costs. Advanced analytics, which combines engineering, data science, and computing capacity, helped the client achieve its goals. Our solutions had the following impact on our client’s business:

- Optimized pricing and discount strategies

- Provided a useful decision-making tool to the client and the sales team for real-time pricing fixing and discounting

- Offered real-time visibility of price fluctuations

- Increased retail discount transparency by leveraging pricing analytics technology

Key Outcomes from Quanzig’s Pricing Analytics Solutions

The client approached Quantzig to leverage its expertise in pricing analytics solutions to improve its retail sales margins. The client’s top concern was analyzing the regulatory norms governing the market environment. To correctly price their products and boost the profitability of their retail products, our client also needed to understand the pricing methods of its competitors and apply appropriate price models.

Quantzig was able to help the client achieve these goals with the implementation of a decision-making tool. This tool gave the client real-time insights that helped them determine optimized pricing and discount strategies.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotConclusion

Pricing analytics is essential for modern businesses aiming to achieve profitability and profit optimization. By utilizing pricing data analytics solutions and predictive analytics, companies can develop effective pricing strategies that lead to informed decisions and increased profitability. The use of advanced pricing analytics solutions and competitive intelligence tools allows for price optimization and the implementation of segmented pricing strategies, ensuring businesses remain competitive in the market. Additionally, robust price management initiatives and the accurate assessment of key pricing metrics support real-world applications that drive sustainable growth and profitability. Keeping track of multiple variables is a tough challenge for stakeholders in the oil and gas sector, which the adoption of advanced analytics solutions can ease.